Compliance Documents

As your Registered Agent, we ensure you company remains compliant with the filings and annual fees made on time, to the company registry.

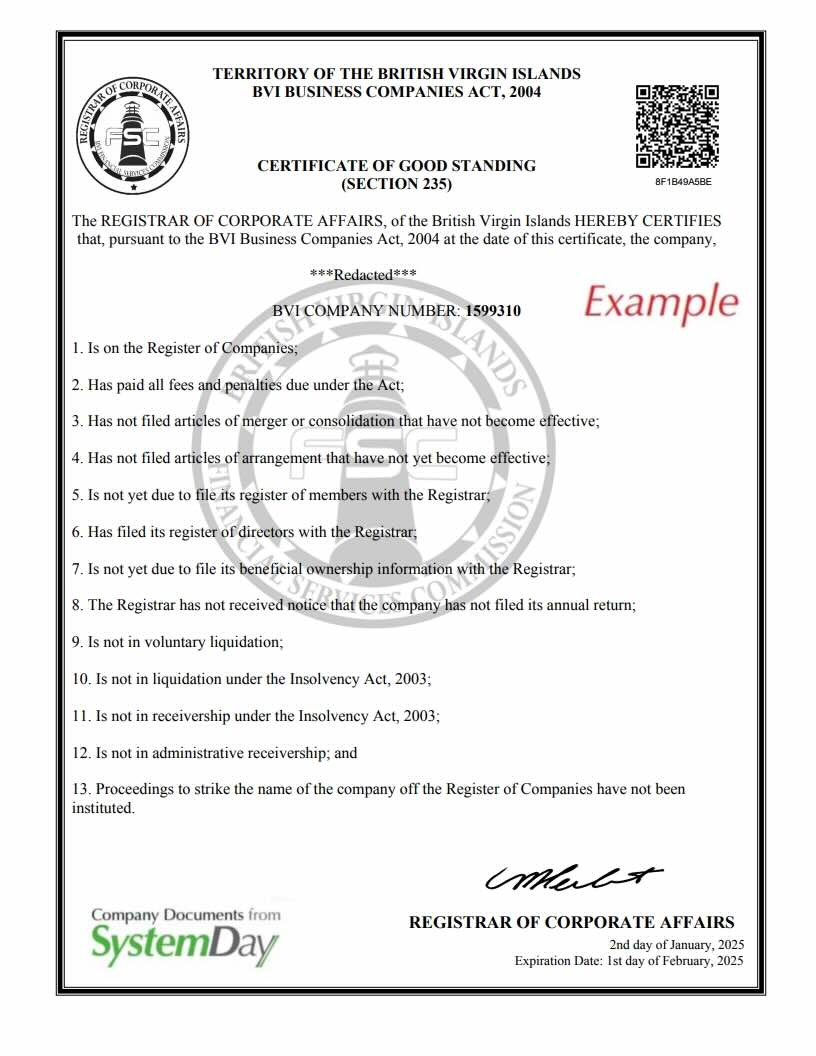

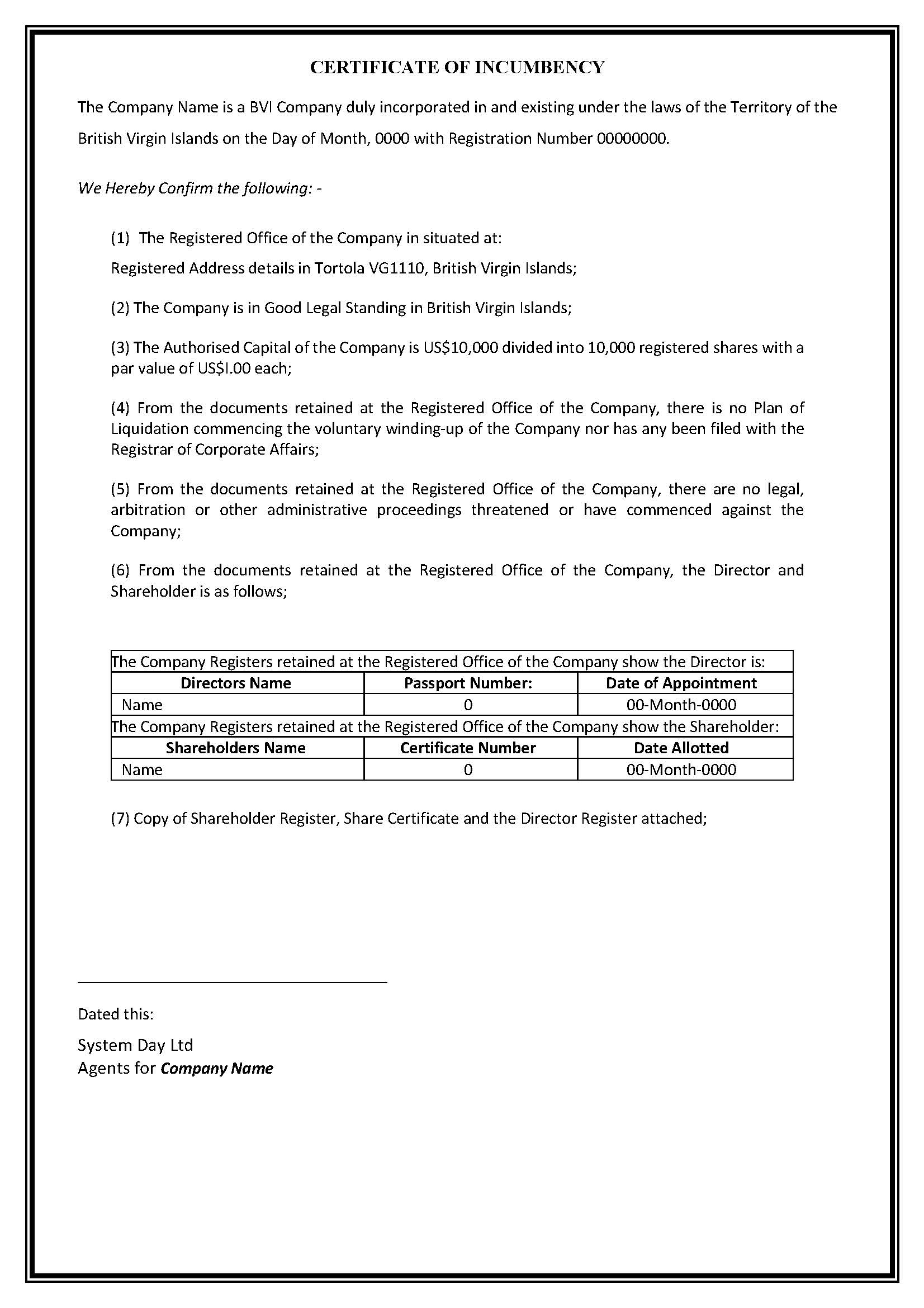

We can supply the Certificate of Good Standing from the registry and a notarised Certificate of Incumbency, showing the Directors and Shareholders.

These certificates will be required by your bank and possibly your customers or suppliers, or simply for your own records.

Directors and Shareholders Register maintenance.

The Directors & Shareholders Register maintenance fee is an administrative charge each year on renewal. As a Corporate Service provider, we hold corporate document copies for every company we provide services to, and this includes electronic copies of the Register of Directors and the Register of Members. It is essential to ensure that statutory Registers are maintained and remain update to date and accurate throughout the life of a company.

Our fee covers time spent monitoring the company file, identifying & addressing any discrepancies, and updating the company Registers accordingly updating changes to directors and shareholders personal details, for example their residential address, must be updated. We will also advise you on the relevant procedures when any corporate changes arise such as share transfer or change of director. There are additional fees which apply for any registry filings and/or drafting of the supporting corporate documents related to changes to the directors or shareholders – including corporate resolutions, board minutes, appointment/resignation letters, share certificates.

It is important to inform us of any changes to your company as the change occurs, to enable us to update the Registers in a timely manner and, if required, assist you with the drafting of supporting corporate documents.

UK Annual Compliance

In line with the Anti-Money Laundering regulations, we complete compliance checks and update the records held at the Registered Office, to ensure your UK company meets its regulatory obligations and remains in Good Standing.

We conduct annual reviews to ensure that the due diligence documentation held on your company file are up to date.

The fee covers the additional time spent monitoring Know Your Client for the Company Directors, Shareholders and other connected entities, in addition to general matters concerning corporate governance and regulatory updates.

Our annual compliance is based on a UK company with standard Share Capital, two Directors and two Shareholders. If your company has a higher Share Capital or additional Directors or Shareholders, there will be additional compliance charges.

UK Shareholder & Directors Maintenance

Under the Companies Act, we need to ensure your company registers, including the directors register and shareholder register are maintained. An updated copy of the Directors register is held at the UK registered office of your company.

If there are changes to the Company Directors of your company, we will need to get updated due diligence records and file an updated directors register with the Companies Registry.

UK Compliance Documents

We email through scanned copies of the Certificates and Courier the originals to you by FedEx/DHL. The UK compliance document pack includes:

1. Registry Certified Certificate of Good Standing issued by UK Companies House

2. Company Search indicating the lasted filings by the company – issued by UK Companies House

3. Certified Certificate of Incumbency for your company with the Company Registers attached:

- Register of Directors – detailed record of every person (past and present) who has been appointed to manage the company on behalf of its shareholders

- Register of Shareholders – contains information on past and present shareholders, providing a continuous record of ownership since the company’s incorporation. This is the most important statutory register your company is required to keep

BVI Annual Compliance

In line with the BVI Anti-Money Laundering rules, we complete compliance checks and update the records held at the registered office, to ensure your BVI company meets its regulatory obligations and remains in Good Standing.

We conduct annual reviews to ensure that the due diligence documentation held on your BVI company file are up to date.

The fee covers the additional time spent monitoring KYC for the company directors, shareholders and other connected entities, in addition to general matters concerning corporate governance and regulatory updates.

Our annual compliance fee is based on an International Business Company (IBC) in the BVI company with standard Share Capital, two directors and two shareholders. If your BVI company has a higher Share Capital or additional directors or shareholders, there will be additional compliance charges.

BVI Economic Substance

The Economic Substance (Companies and Limited Partnership) Act 2018 requires that entities conducting specifically targeted ‘relevant activities must show substance/presence in the British Virgin Islands unless they can demonstrate tax residency in another jurisdiction.

The 9 relevant activities are as follows:

- banking business

- insurance business

- fund management business

- finance and leasing business

- headquarters business

- shipping business

- holding business

- intellectual-property business

Every BVI registered company must inform the BVI International Tax Authority of its Economic Substance status each year. The company must provide a completed declaration, and the respective filing is submitted by the company’s Registered Agent via the Beneficial Owner Secure Search System (“BOSSS”), an online portal. The filing deadline is 6 months after the financial year end date.

The Economic Substance (Companies and Limited Partnership) Act 2018 came into force in the British Virgin Islands to address tax system concerns of the European Union and the OECD. The BVI International Tax Authority has been task with enforcing the Act which requires that all BVI companies must inform the Tax Authorities of their Economic Substance status. We assist with the Economic Substance filing which is within 6 months after the end of your financial period.

Under the Economic Substance Act 2018 and the Beneficial Ownership Secure Search System Act 2017 the Economic Substance Portal is integrated with the Beneficial Ownership Secure Search system (BOSSs). The required filing is made on the online portal by the BVI registered Agent for your BVI registered company.

The Economic Substance (Companies and Limited Partnership) Act requires all companies and limited partnerships conducting “relevant activities” to show substance/presence in the BVI, unless they are tax resident in another country.

All BVI companies must inform the International Tax Authority of their Economic Substance status. An initial legal assessment will be mandatory for every BVI company, and an Economic Substance filing must be submitted annually to the International Tax Authority.

BVI Compliance Documents £900

We email through scanned copies of the Certificates and Courier the originals to you by FedEx/DHL. The BVI compliance document pack includes:

1. Registry Certified Certificate of Good Standing issued by the BVI Register of Companies

2. Company Search indicating the lasted filings by the company – issued by the BVI Register of Companies

3. Certified Certificate of Incumbency for your company with the Company Registers attached:

- Register of Directors – detailed record of every person (past and present) who has been appointed to manage the company on behalf of its shareholders

- Register of Shareholders – contains information on past and present shareholders, providing a continuous record of ownership since the company’s incorporation. This is the most important statutory register your company is required to keep

BVI Shareholder & Directors Maintenance

Under the BVI Business Companies Act, 2004 we need to ensure your BVI company registers, including the directors register are maintained. An updated copy of the Directors register is held at the BVI registered office of your company. If there are changes to the Directors of your BVI company, we will need to get updated due diligence records and file an updated directors register with the BVI companies registry.

Seychelles Compliance Documents

We email through scanned copies of the Certificates and Courier the originals to you by FedEx/DHL. The Seychelles compliance document pack includes:

1. Registry Certified Certificate of Good Standing issued by the Seychelles Financial Services Authority

2. Company Search – issued by the Seychelles Financial Services Authority

3. Certified Certificate of Incumbency for your company with the Company Registers attached:

- Register of Directors – detailed record of every person (past and present) who has been appointed to manage the company on behalf of its shareholders

- Register of Shareholders – contains information on past and present shareholders, providing a continuous record of ownership since the company’s incorporation. This is the most important statutory register your company is required to keep

Seychelles Annual Compliance

In line with the Anti-Money Laundering regulations, we complete compliance checks and update the records held at the Registered Office, to ensure your Seychelles company meets its regulatory obligations and remains in Good Standing.

We conduct annual reviews to ensure that the due diligence documentation held on your company file are up to date.

The fee covers the additional time spent monitoring Know Your Client for the Company Directors, Shareholders and other connected entities, in addition to general matters concerning corporate governance and regulatory updates.

Our annual compliance is based on a Seychelles company with standard Share Capital, two Directors and two Shareholders. If your company has a higher Share Capital or additional Directors or Shareholders, there will be additional compliance charges.

Ireland Compliance Documents

We email through scanned copies of the Certificates and Courier the originals to you by FedEx/DHL. The Ireland compliance document pack includes:

1. Registry Certified Certificate of Good Standing issued by the Irish Companies Registration Office

2. Company Search indicating the lasted filings by the company – issued by the Irish Companies Registration Office

3. Certified Certificate of Incumbency for your company with the Company Registers attached:

- Register of Directors – detailed record of every person (past and present) who has been appointed to manage the company on behalf of its shareholders

- Register of Shareholders – contains information on past and present shareholders, providing a continuous record of ownership since the company’s incorporation. This is the most important statutory register your company is required to keep

Ireland Annual Compliance

In line with the Anti-Money Laundering regulations, we complete compliance checks and update the records held at the Registered Office, to ensure your Irish company meets its regulatory obligations and remains in Good Standing.

We conduct annual reviews to ensure that the due diligence documentation held on your company file are up to date.

The fee covers the additional time spent monitoring Know Your Client for the Company Directors, Shareholders and other connected entities, in addition to general matters concerning corporate governance and regulatory updates.

Our annual compliance is based on an Ireland company with standard Share Capital, two Directors and two Shareholders. If your company has a higher Share Capital or additional Directors or Shareholders, there will be additional compliance charges.

Compliance Certificate examples

|  |